Quicken For Mac 2016 Personal Finance & Budgeting Software

Quicken for Mac Personal Finance & Budgeting Software. Easy money and investment management.Organizes your personal finance, bank, credit card, investment & retirement accounts in one place. Stay on top of spending and budgeting. Create a realistic budget. See how your investments are performing. View full Quicken 2016 for Mac specs on CNET. Quicken Home & Business 2016 Personal Finance & Budgeting. Includes Everything in Business, Plus: Categorizes your personal spending and your business expenses, automatically. Saves you money by finding tax-deductible business expenses. Shows the profit and loss for your business at a glance, so you always know where you stand.

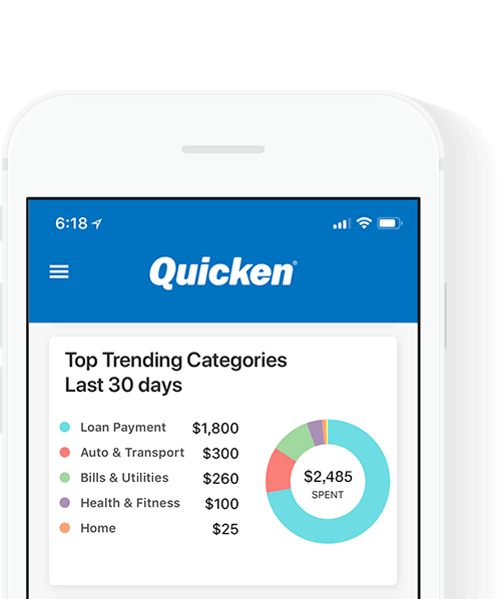

Quicken Deluxe Personal Finance & Budgeting Software helps you manage your money and save. Organizes your personal finance, bank, credit card, investment, and retirement accounts in one place. Stay on top of spending and budgeting. Create and stick to a budget.

Develop a personal debt reduction and savings plan. Securely imports your bank transactions through April 2019. Access your personal finance data on the go and make smart money management decisions with free Quicken mobile app for iPhone, iPad and Android devices. Bill Center see, track, and pay your bills all in one place.

Most popular money management software. Millenium panel build 12.2016 for adobe photoshop (win/mac) mediafire. How to write personal data sheets. Microsoft office for mac site:youtube.com. Easy bill tracking. Free phone support. Even easier to upgrade. • Categorizes expenses and helps you stay on top of spending and budgeting • Create and stick to a budget • Develop a personal debt reduction and savings plan • Securely imports your bank transactions through April 2019.

This review is from: Quicken Deluxe 2016 Personal Finance & Budgeting Software (Software Download) I’ve been using Quicken for years. I don’t upgrade yearly, though, because there are no significant advantages in doing so. This year was no exception. I moved from a very stable 2013 to 2016.

Now, frequently when I run Quicken I have to kill the process because it hangs when I move between accounts. I’ve not figured out why, but if I update banking information, then move from one account to another to check balances, etc. I’ve learned it’s best to go in and just do one thing, exit, then come back. That’s a bit sad. Otherwise, it pretty much works and acts like 2013. So, what did I pay for? The one benefit I did get is that it no longer pesters me to upgrade.

That’s good, I guess. I give Quicken 2016 three stars because, in spite of its shortcomings, Quicken is still pretty good software. What it is not, however, is worth the price they charge to upgrade. It’s definitely worth buying if you don’t have financial management software of any sort, but the price of the upgrade is high for what you get. The software pretty much looks exactly like 2013 and the versions year-after-year before that. I’ve not found any new bells and whistles to get me excited.

Intuit claims the following new features for Windows (from their web site): * Now easier than ever to stay on top of your bills – Link your bills and Quicken will automatically track the due date and the amount due. Waste of money upgrading from 2015 to 2016. First, problem installing. Second, the syncing with the banks are worst off. I purchased it in hoping to have better sync with banks. So far been a nightmare.

I have been Quicken user for a long time. The last few release were nothing but disappointment. I am not sure if it’s Quicken or Synchrony Bank. As large and as many consumers using it, they don’t seem to be updating accurately. As far of the new features, I don’t see any differences at all. Nothing but disappointment.